By Jake Frisson, Realtor® – Helping Families Find and Style Homes in Maple Ridge, Langley, and the Fraser Valley

Hey everyone, as we kick off 2026 here in Maple Ridge and Langley, I'm seeing a real shift in what buyers are excited about when touring homes. Design trends this year are all about creating warm, inviting spaces that feel grounded and connected to nature. It's a perfect match for our beautiful BC surroundings with all the trees, mountains, and outdoor lifestyle we love.

:max_bytes(150000):strip_icc()/H9_SPRINGBANK-206-521a04fc5ecc4199abea1b9257e5be20.jpg)

Whether you're thinking of buying, selling, or just refreshing your current place, these trends can make a big difference in how a home feels and how quickly it sells. Let's break down what's hot for interiors and exteriors this year.

Interior Trends Shaping Homes in 2026

This year, interiors are moving toward cozy, expressive spaces. Goodbye to stark minimalism — hello to warmth, texture, and personality.

Warm, earthy color palettes are everywhere. Think rich umbers, ochre, pistachio greens, desaturated blues, and even pops of red or chartreuse. These colors create a calming, grounded feel that's ideal for our rainy West Coast days.

5 Decor Styles That Will Define 2026, According to Experts ...

Soft curves and organic shapes are taking over from sharp edges. Curved sofas, rounded arches, and plush furniture make rooms feel more inviting and comfortable.

Natural materials like wood, stone, and textured fabrics are key. Kitchens with warm wood cabinets or stone accents feel timeless and bring the outdoors in, something buyers in our area really respond to.

Personalized maximalism is making a comeback. Layered textures, bold accents, and collected pieces over time create homes that tell a story rather than looking like a showroom.

6 expert decor ideas for a maximalist living room | Homes and Gardens

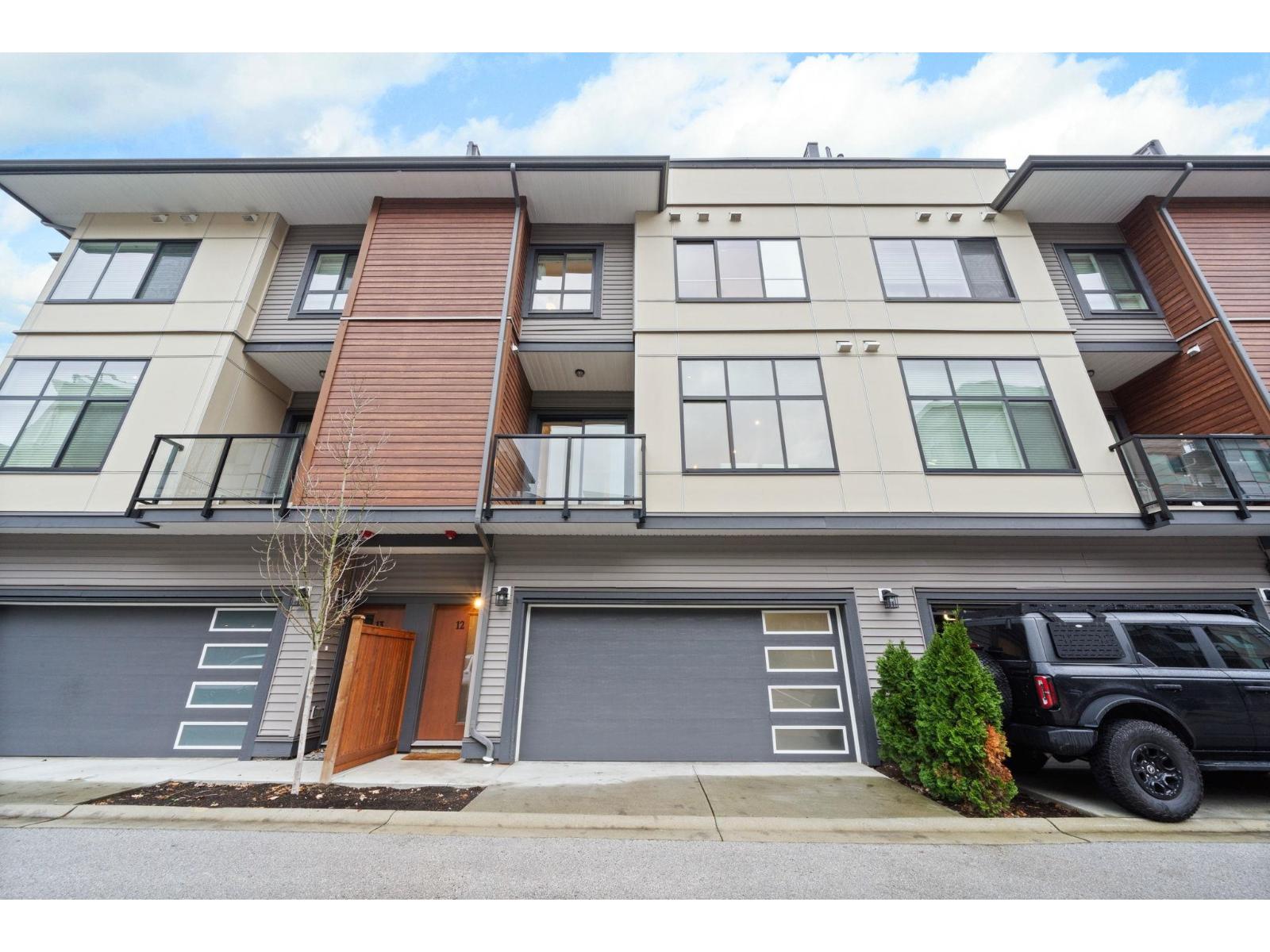

Exterior Trends Boosting Curb Appeal This Year

On the outside, 2026 is about timeless warmth and blending with nature while adding modern character.

Earthy, sophisticated colors are replacing bright whites. Sage greens, warm taupes, blue-grays, and even dramatic blacks or creams give homes a cozy, enduring look.

Most Popular Exterior Paint Colors Of 2025 - brick&batten

Mixed materials add depth and interest. Combining wood siding, brick, stone, or metal creates texture that stands out beautifully against our green backdrops.

Seamless indoor-outdoor flow is huge. Large sliding doors, covered patios, and connected living spaces make the most of our mild weather and views.

Sustainable features like energy-efficient windows, natural landscaping, and eco-friendly materials not only look great but appeal to buyers thinking long-term.

Why These Trends Matter in Our Local Market

In Maple Ridge and Langley, homes that embrace nature-inspired warmth and thoughtful details tend to attract more interest and hold value better. If you're selling, small updates like fresh paint in earthy tones or adding textured accents can make your listing pop. For buyers, look for properties with good bones that align with these trends — they're likely to feel like home right away.

Thinking About Updating or Finding a Home That Fits These Trends?

I'd love to help. Whether you're browsing listings in Maple Ridge or Langley, planning a refresh to sell, or just want ideas for your space, reach out. I can share current homes that nail these 2026 vibes or connect you with great local pros for renovations.

Jake Frisson, Realtor® Phone: 778-238-3463 Email: jake@jakefrisson.com Website: jakefrisson.com

What trend are you most excited to try this year? Or do you have a home project in mind? Drop a comment or message me. I always enjoy hearing from local folks!

Subscribe with RSS Reader

Subscribe with RSS Reader