By Jake Frisson, Realtor® – Helping Families Find Homes in Maple Ridge, Langley, and the Fraser Valley

Hey there, if you're a first-time buyer in Maple Ridge or Langley, you've probably asked yourself whether it's smarter to keep renting and put your money into stocks or finally take the plunge into homeownership. As someone who's lived and worked in this area for years, I get that question a lot. And right now, in early 2026, I truly believe buying is the stronger move for most people planning to stay put for a while.

What's Happening in Our Local Market Right Now

The Fraser Valley market, including Maple Ridge and Langley, has cooled off a bit heading into 2026. Benchmark prices are sitting around $927,000 in Maple Ridge and about $906,000 in Langley for all property types combined. We've seen some softening from last year's peaks, with more inventory on the market and homes taking a little longer to sell. That means less competition and more room for buyers to negotiate. It's shifted into a buyer-friendly market in many neighborhoods, which, unless you have been living under a rock hasn't happened in many many years!

Historically, properties here in the Lower Mainland have appreciated around five to seven percent annually over the long term. Even with these short-term dips, getting in now sets you up well for the rebound most experts are expecting as interest rates stay steady and demand picks up again.

Leverage: The Real Game-Changer in Real Estate

What really sets real estate apart is leverage. You don't have to pay cash for the whole house; the bank lets you borrow most of it.

Take a typical example I see with my clients: You've saved $100,000 for a down payment and buy a $700,000 home, which is very doable in Maple Ridge or Langley right now.

If the value goes up just five percent in the first year (pretty conservative based on our history), that's roughly a $35,000 gain. On your $100,000 investment, you're looking at over 30 percent return, and it's tax-free since this is your principal residence.

Try finding that kind of consistent return in the stock market. The S&P 500 averages nine to ten percent long-term, which is great, but on $100,000 invested directly, a good year might net you $15,000. Real estate's leverage just multiplies your gains.

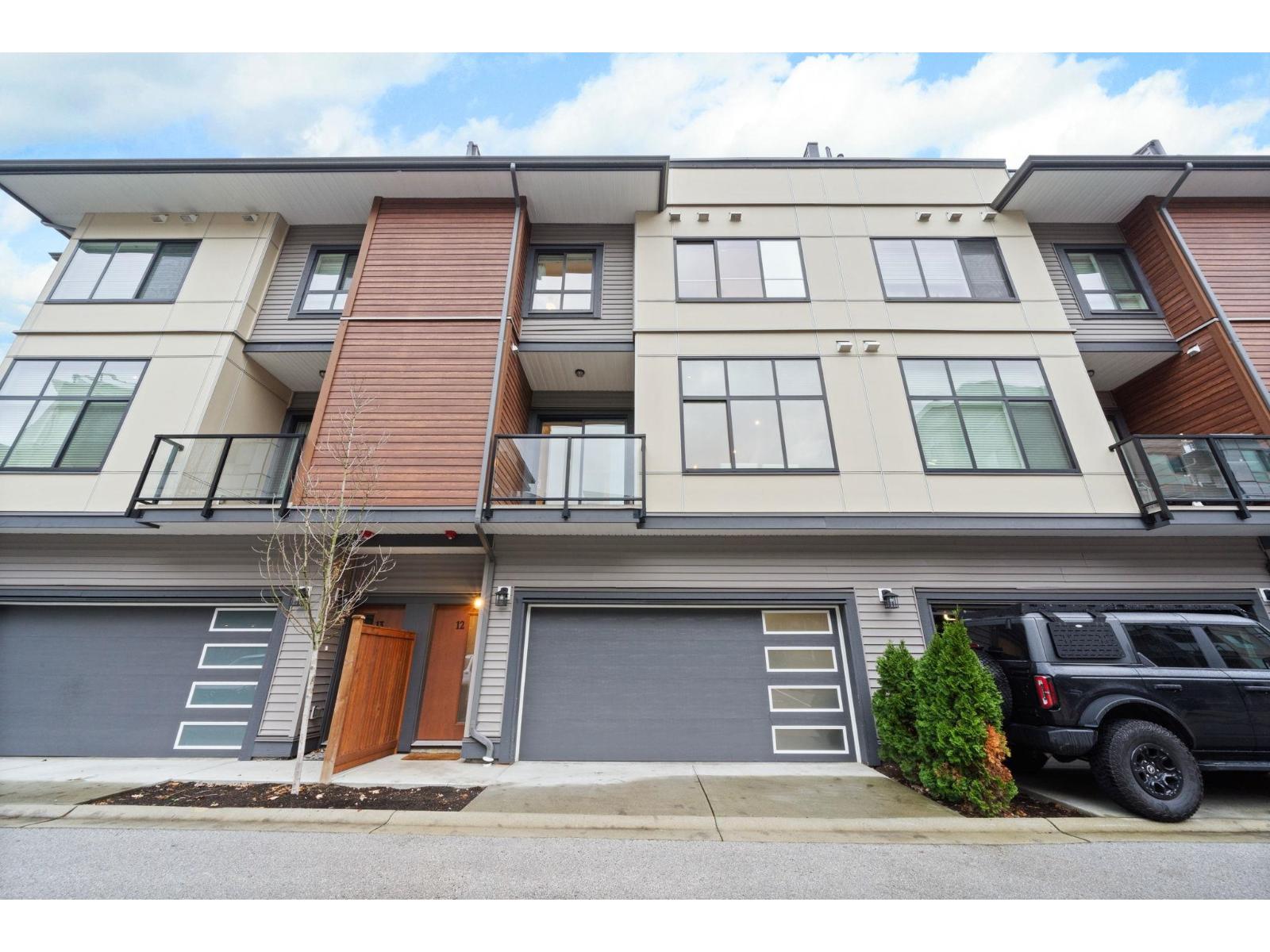

10031 247b St, Maple Ridge, BC V2W 0H1 | MLS #R3083933 | Zillow

Building Equity Instead of Paying Someone Else's Mortgage

With a mortgage, part of every payment goes toward paying down the principal. It's like forced savings that grows your net worth month after month. Over ten years, even with modest appreciation, you could build hundreds of thousands in equity from that initial down payment.

Renting? Your monthly payment builds nothing for you. In many cases around here, rent for a similar place is close to what a mortgage would cost. The big difference is one path has the opportunity to create massive wealth and the other doesn't. Theres the old says that most millionaires become millionaires because of Real Estate

The Down Payment Challenge (And How People Overcome It)

I know, saving that down payment feels like the toughest part. That's why so many of my first-time buyers get a boost from family. Parents or grandparents often help out; it's one of the most common ways people get started in our market. There are also programs like the First-Time Home Buyer Incentive or pulling from your RRSP that can make it easier.

The Honest Truth: Owning Isn't Perfect for Everyone

Of course, buying comes with responsibilities. You'll have property taxes, insurance, maintenance (I always tell clients to budget one to two percent of the home's value each year), and the occasional surprise repair. If you might move soon or just don't want the hassle of upkeep, renting gives you more flexibility. And if prices drop short-term, leverage can amplify losses too. For some lifestyles, renting and investing the difference aggressively in stocks makes total sense.

Why I'm Excited for Buyers Right Now in Maple Ridge and Langley

These communities offer so much: great schools, parks, trails, and easy commuting without the insane Vancouver prices. With the current market giving buyers more power, this year feels like a sweet spot for getting in.

Stocks are fantastic for growth, but real estate lets you live in your investment, benefit from leverage, enjoy tax advantages, and build equity over time.

Let's Talk About Your Situation

If you're thinking about making a move in Maple Ridge, Langley, or anywhere in the Fraser Valley, reach out. I'll go over the latest listings, run numbers specific to your budget, and guide you through everything from pre-approval to keys in hand.

Jake Frisson, Realtor® Phone: [778-238-3463] Email: [jake@jakefrisson.com] Website: [jakefrisson.com]

The best time to buy is when it fits your life and the numbers work. I'd love to help you get into your first home this year.

What's holding you back from buying right now, or what excites you most about it? Send me a message. I always enjoy chatting with local buyers.

Subscribe with RSS Reader

Subscribe with RSS Reader

Comments:

Post Your Comment: